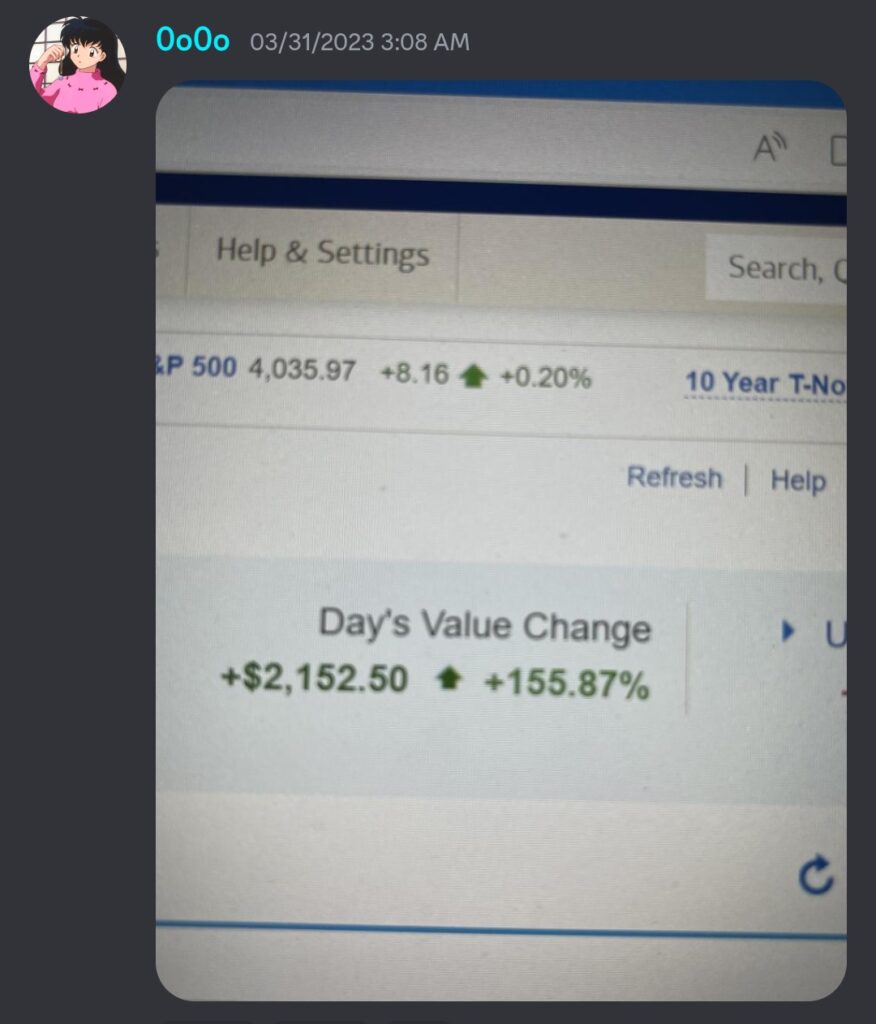

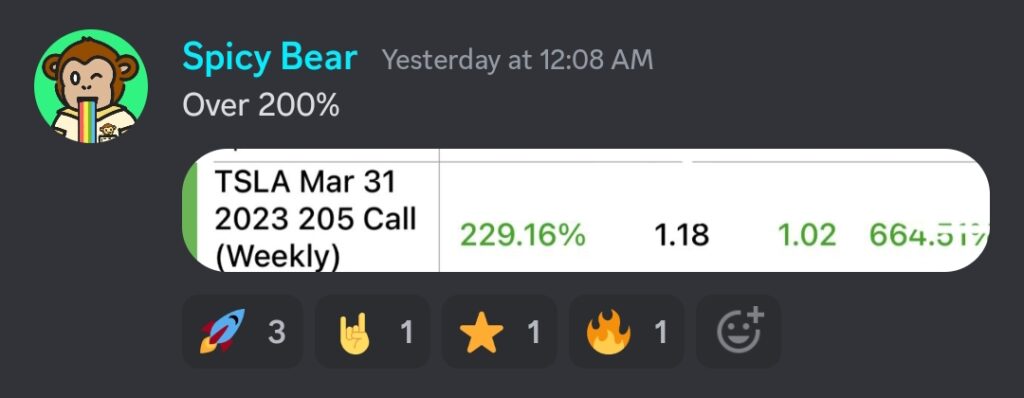

This week was rather quiet, with concerns around the global banking system beginning to settle down. When you combine this with the fact that PCE data came in a bit cooler than expected, you have a recipe for a green week in the stock market. This led all of the major US indices to be up between two and three percent week-over-week. Barring any unforeseen bank collapses or other globally notable events, we should be in for another relatively quiet week in the stock market this week!

One of the largest movers for the market last week came on Friday, as PCE data was released. Year-over-year PCE came in at 5%, compared to 5.3% last month, and year-over-year core PCE came in at 4.6%, compared to last month’s 4.7%. This continued, steady decline in inflation has been welcomed by the market with open arms, as the Fed will likely stop raising interest rates very soon.

This week will be another relatively sleepy week for economic data releases. While there aren’t many market-moving releases, you may want to pay attention to the job openings release on Tuesday, The ADP employment report on Wednesday, as well as the unemployment report, average hourly wages, and consumer credit reports on Friday. The aforementioned reports should help better understand how the average US consumer is faring amidst these trying times!

Although no notable companies are reporting earnings this week, things should begin to pick back up soon, as the first quarter just closed out! Be sure to check back next week to see which companies will be reporting their Q1 earnings!

Monitoring the market conditions this week.

Want to stay in the know? Want tips delivered right to your inbox? Simply provide your email address below and you’ll get a high-value newsletter, designed to help you trade stronger.