With a decline in the rate of inflation last week, we saw yet another week of green, with all of the major indices up between one and three percent. It appears that we’ve made it through the rough waters of Q2 earnings and government data releases, and it will be smooth sailing for a bit. There aren’t any huge market catalysts in the coming weeks, so things should be much less volatile than they have been lately.

As we mentioned before, the rate of inflation decreased in July, and came in below analyst expectations. We saw a year-over-year inflation rate of 9.1% in June and analysts were expecting things to cool down a bit, to around 8.7% in July. This was mainly attributed to falling energy prices, resulting in lower prices at the pump for consumers, and lower transportation costs for goods. The actual numbers came in at 8.5%, representing a huge beat for inflation, and an incredibly positive catalyst for markets.

This coming week is rather slow in terms of market catalysts. There aren’t really any influential, market-moving data releases. However, some data releases that are worth paying attention to are Housing Starts and Building permits on Tuesday, Retail Sales and Business Inventories on Wednesday, and Jobless Claims on Thursday. These likely won’t move the market in any significant way, however, we could see some interesting data points, as we did with Nominal Credit Card Debt, just a couple of weeks ago:

There are a couple of rather large earnings releases, mainly in Walmart and Target that could move the market if they have concerning comments on inventories like they did last quarter. We’ll discuss these earrings calls and more in the next section:

08/15 – Li Auto (LI), Nu Holdings (NU), ZipRecruiter (ZIP)

08/16 – Walmart (WMT), The Home Depot (HD), BHP Group (BHP)

08/17 – Cisco Systems (CSCO), The Lowe’s Corporation (LOW), The TJX Companies (TJX), Target (TGT), Bath and Body Works (BBWI)

08/18 – The Estee Lauder Companies (EL), Applied Materials (AMAT), Ross Stores (ROST), Bill.com Holdings (BILL), BJ’s Wholesale Club Holdings (BJ)

08/19 – Deer & Company (DE), Foot Locker (FL)

With earnings season starting to slow down, we’re not seeing as many major companies report earnings. However, we do have a few big ones this week!

All eyes will be on WMT, TGT, BJ, HD, and LOW this week. Everyone wants to hear what they have to say about inventories, as WMT and TGT sold off heavily after their Q1 release due to skyrocketing inventories. HD, DE, and LOW will also give us a good idea of how the construction industry is holding up in these inflationary times.

LI and NU will give us some insight into how foreign markets are behaving, and what problems they are facing. This will help give us a better understanding of the overall global macroeconomic environment.

Lastly, companies like TJX, BBWI, EL, ROST, and FL will give us an idea of where the consumer is spending their money. We could see a sell-off with these companies, as gas prices and inflation reached highs in June, which likely led to less spending on consumer discretionaries.

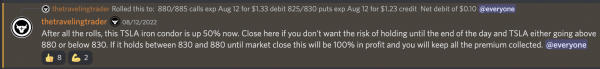

Options Wins from Last Week (Check out our 50% TSLA trade! 🔥)

Check out our popular courses

Want to stay in the know? Want tips delivered right to your inbox? Simply provide your email address below and you’ll get a high-value newsletter, designed to help you trade stronger.