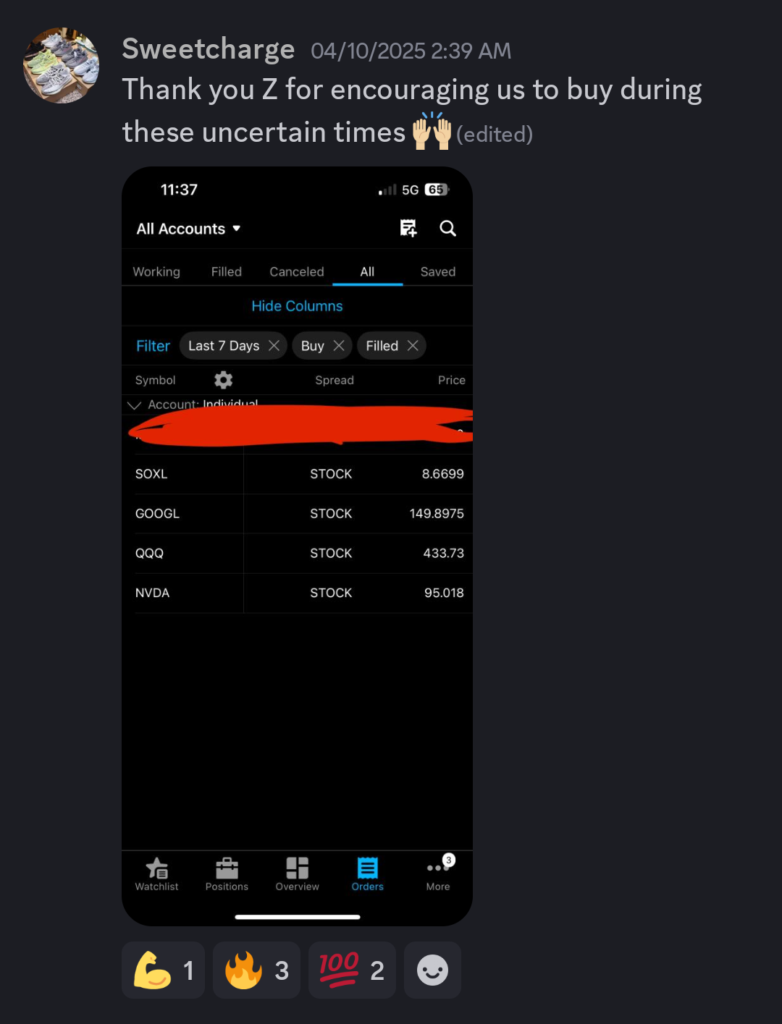

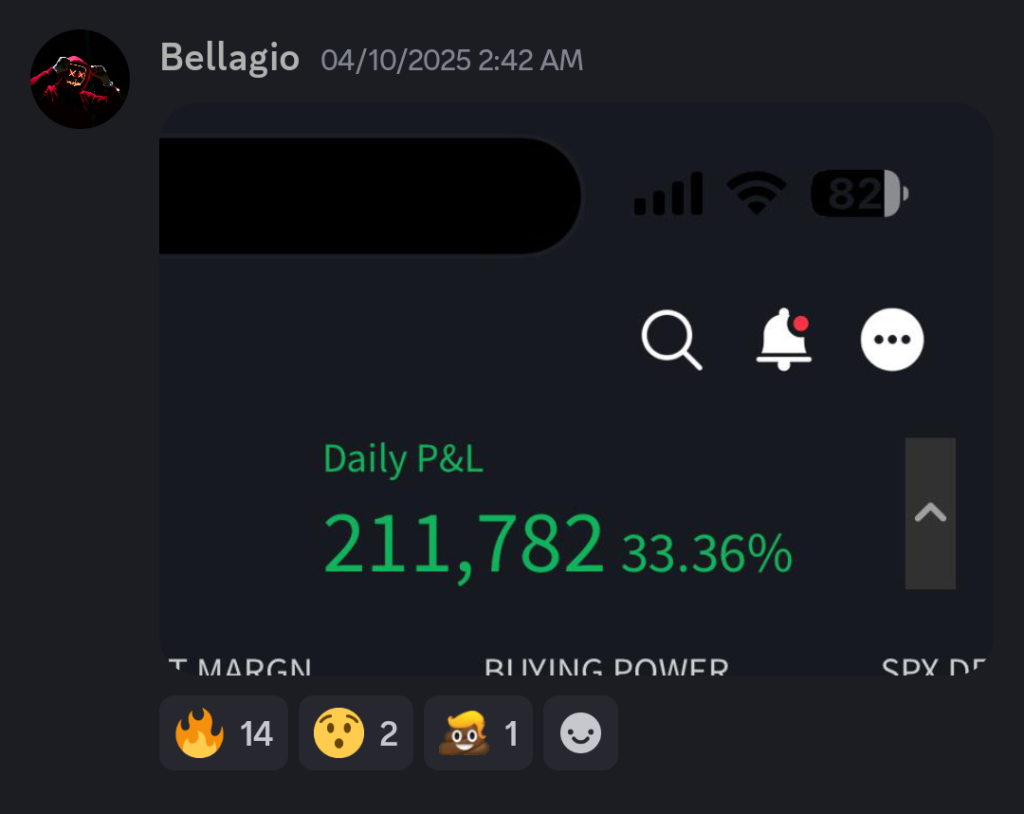

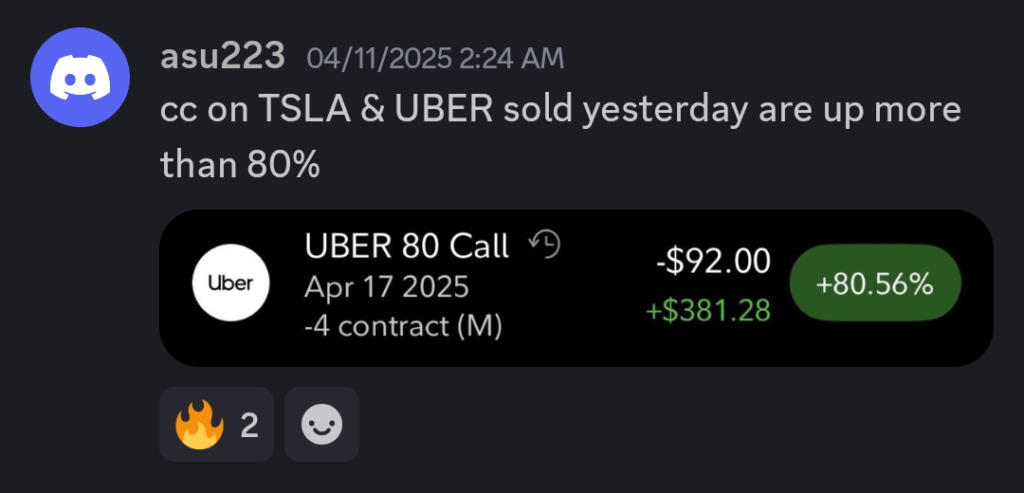

These past couple of weeks have been incredibly turbulent and volatile. Two weeks ago, we had one of the biggest down weeks we’ve seen in quite some time. However, this past week was quite the opposite. Over the course of the past week, the Russell was up 4.34%, the Dow was up 7.54%, the S&P was up 7.78%, and the Nasdaq was up a whopping 9.13%! Unfortunately, though, we’re nowhere near out of the woods yet, as earnings season is just beginning!

Quite possibly the most important thing that happened last week was Trump’s pause on the tariffs. As of right now, all reciprocal tariffs are paused for every country but China. It will be important to keep an eye on this matter, as moves in tariff policy will move markets in a huge way in the future.

Additionally, the second most important thing that came out of last week is that CPI came in quite a bit lower than anticipated, with year-over-year CPI coming in at 2.4%, compared to an expected 2.6%, and Core CPI came in at 2.8% compared to an anticipated 3.0%!

Luckily for us, things are relatively quiet this week in terms of economic data release. We kick things off on Wednesday with retail sales data as well as the home builder confidence index. We then get to see the housing starts, building permits, and Philly Fed manufacturing survey on Thursday! It’ll be particularly important to pay attention to retail sales, as March will likely serve as an important baseline, given all of the tariff drama that has taken place over the course of the past couple of weeks!

This week, earnings season kicks off as we have some of the most influential companies reporting their earnings, such as:

04/14 – Goldman Sachs Group (GS), M&T Bank (MTB)

04/15 – Johnson & Johnson (JNJ), Bank of America (BAC), Citigroup (C), PNC Financial Services (PNC), Ericsson (ERIC), United Airlines (UAL), Interactive Brokers (IBKR)

04/16 – ASML (ASML), Abbott Laboratories (ABT), Prologis (PLD), US Bancorp (USB), Kinder Morgan (KMI), The Travelers Companies (TRV), CSX (CSX), Wipro (WIT), Las Vegas Sands (LVS)

04/17 – Taiwan Semiconductor Manufacturing (TSM), UnitedHealth Group (UNH), Netflix (NFLX), American Express (AXP), Marsh & McLennan (MMC), Blackstone (BX), Infosys (INFY), D.R. Horton (DHI), State Street (STT)

It’ll be particularly important to pay attention to what TSM and ASML have to say this week, as these companies are intimately involved in the chip-making process. They will likely give some great commentary that will move big tech names like AMZN, MSFT, AAPL, GOOG, META, and NVDA!

It’ll also be important to pay attention to what the banks are saying, as well as AXP. AXP in particular will be able to give some great commentary on where they see people and SMBs spending money!

Monitoring the market conditions this week.

Want to stay in the know? Want tips delivered right to your inbox? Simply provide your email address below and you’ll get a high-value newsletter, designed to help you trade stronger.