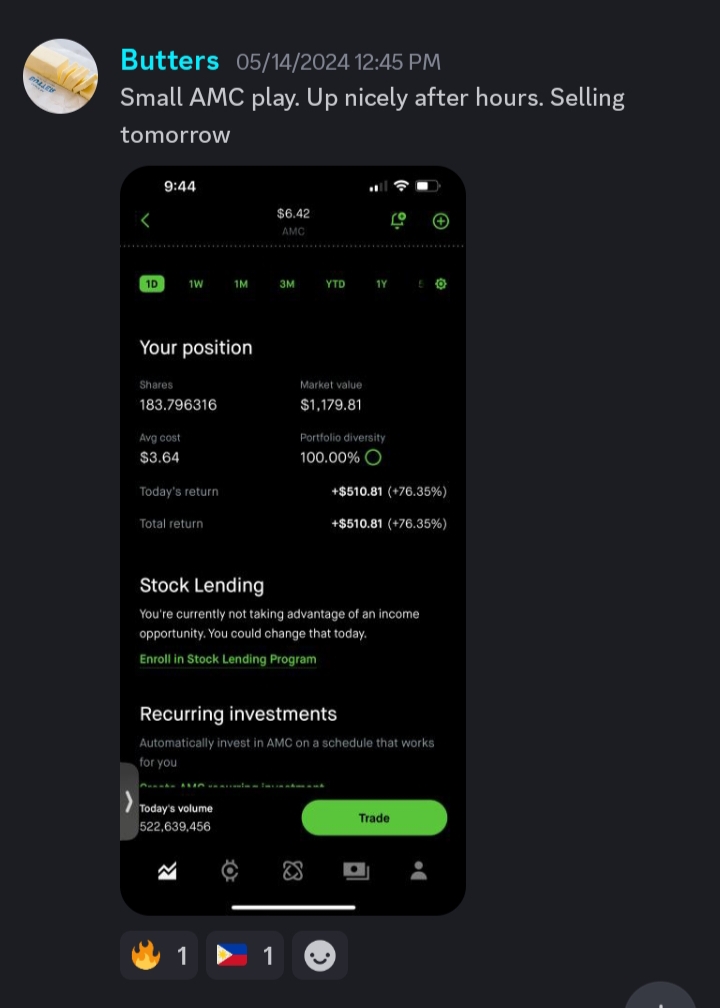

Last week, we saw a tremendous amount of green in the market, with the Russell up 0.78%, the Dow up 0.95%, the S&P up 1.39%, and the Nasdaq up 1.91%. We also saw the resurgence of meme stocks as Roaring Kitty (aka Keith Gill) made a return to Twitter after years of radio silence. His return sent countless meme stocks, like GME and AMC, soaring as retail (and institutional) traders dumped money into these stocks. Although we all thought that this period of time was over, it may have been reborn; however, only time will tell.

Last week, we saw some interesting economic readings, with PPI missing expectations and CPI coming in line with expectations. This spike in producer prices may mean that inflation will be hitting consumers in the coming months. We also saw some misses in terms of housing starts and building permits, as the real estate market remains incredibly slow under the pressure of high interest rates.

This week remains relatively calm in terms of economic data releases. Throughout the week, various Fed officials will speak and address the press leading up to the release of the Fed’s May FOMC meeting minutes on Wednesday. This release will be accompanied by existing home sales. We’ll then get to see initial jobless claims and new home sales on Thursday, followed by the final reading of consumer sentiment on Friday. It’ll be particularly important to pay attention to consumer sentiment, as the preliminary readings showed that consumer sentiment is at around the same level as it was during the Great Financial Crisis.

This week, earnings season continues, as we see some rather large companies reporting, such as:

05/20 – Palo Alto Networks (PANW), Trip.com Group (TCOM), Keysight Technologies (KEYS), Li Auto (LI), Zoom Video Communications (ZM)

05/21 – Lowe’s Companies (LOW), AutoZone (AZO), Toll Brothers (TOL)

05/22 – NVIDIA (NVDA), PDD Holdings (PDD), TJX Companies (TJX), Analog Devices (ADI), Synopsys (SNPS), Target Corporation (TGT), Snowflake (SNOW), Williams-Sonoma (WSM)

05/23 – Intuit (INTU), Medtronic (MDT), Toronto Dominion Bank (TD), Workday (WDAY), NetEase (NTES), Autodesk (ADSK), Ross Stores (ROST), Dollar Tree (DLTR), KE HOldings (BEKE), Deckers Outdoor (DECK), Ralph Lauren (RL), BJ’s Wholesale Club (BJ)

All eyes will be on NVDA this week as the AI-chip giant reports its Q1 earnings. Everyone will be glued to their seats, eager to hear what Jensen Huang has to say about the business. This earnings report will undoubtedly move markets one way or another. Artificial intelligence has been underpinning the market rally we’ve seen over the past month, and NVDA is the frontrunner in the space, so this report will make or break the market this week!

Monitoring the market conditions this week.

Want to stay in the know? Want tips delivered right to your inbox? Simply provide your email address below and you’ll get a high-value newsletter, designed to help you trade stronger.